Carrier Cash Cow? - Apple Inc. (AAPL) is expected to introduce the next iPhone model on Wednesday, setting the stage for a critical test of wireless carriers' efforts to bend the economics of the popular device to their advantage.

At stake is how profits in the wireless industry get divvied up and to what degree the carriers reap a return on investments in their newest networks.

In just a half a decade, the iPhone has become one of the most important influences on carriers' profits, and its influence is growing. Carriers like AT&T Inc. (T) and Verizon Wireless pay huge sums for the device and then sell it to their subscribers for much less, a profit-damping subsidy that sends billions of dollars in wealth to Apple.

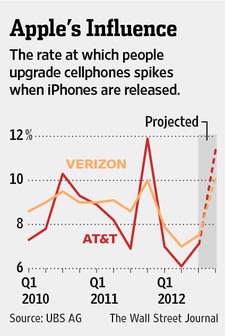

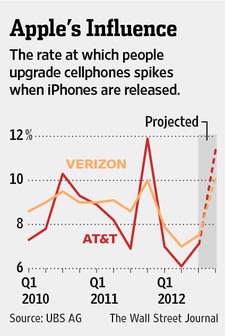

Their subscribers, meanwhile, have increasingly been waiting for new iPhones to be released before upgrading their devices.

The carriers have fought back this year, introducing new upgrade fees to reduce the cost of subsidizing all those new iPhones.

But the biggest impact could come from new data plans debuting this summer, which should squeeze more money from subscribers hooked on the new phone's faster data speeds.

Among carriers the hope is that the new iPhone—running for the first time on the fastest fourth-generation networks— will change consumer behavior. Downloading videos and surfing the Web should be a more seamless, and more profitable, undertaking.

Validas LLC, a company that tracks wireless bills, surveyed 275,000 smartphone owners in the U.S. and found a big difference between data use by people who carry LTE phones. People carrying smartphones that weren't enabled for LTE averaged 500 megabytes of data per month in 2012, Validas found. But the average data use for an LTE subscriber was 1.2 gigabytes per month.

"These new devices and the apps that roll with them are going to drive more data usage," Verizon Communications Inc. (VZ) Chief Executive Lowell McAdam told investors Friday. "As you move off of 3G and on to 4G your usage should go way up and your costs should go down."

Carriers have had a good run this year, with shares in AT&T up 24% and Verizon up 10%, fueled in part by better margins. Wall Street is debating whether that mainly reflects the lull between new iPhone releases or a more sustainable reworking of carriers' economics.

From the perspective of telecom companies, the economics of the iPhone boils down to trading high upfront costs for the promise of locking subscribers into higher phone bills under two-year contracts.

U.S. carriers' data revenue has indeed grown quickly since the iPhone was introduced in June 2007—$17.1 billion in the second quarter versus $5.2 billion five years earlier, according to UBS AG (UBS). But analysts have focused on the negative effects of those upfront costs.

This phenomenon is illustrated in the financial performance of AT&T, which became the first company to carry the iPhone.

In last year's fourth quarter, after the iPhone 4S went on sale, 12% of AT&T's cellphone customers upgraded to new phones and the carrier's wireless profit margin plummeted by a third to 29%, according to UBS. In the second quarter of this year, as many people waited for the new iPhone, just 6% of AT&T customers upgraded and the carrier's profit margin shot up to 45%.

To keep those swings from biting deeply into profits, AT&T and Verizon Wireless moved earlier this year to charge customers more for upgrades. Verizon imposed a $30 fee for some customers, and AT&T doubled its upgrade fee to $36.

The carriers are also being less generous than in prior years, when they allowed their subscribers to upgrade to new iPhones well before they completed their two-year contracts.

"We believe this approach lowers the risk that the carriers will capitulate to demand for a hot new device, as they did with some past device launches," UBS analyst John Hodulik said in a note to clients last month that detailed some of the carriers' moves to reduce spending on device upgrades.

More significantly, the new iPhone has the potential to trigger another jump in carriers' data revenue.

Verizon and AT&T have long done away with unlimited data plans for new customers in favor of tiered data plans. This summer, they took that strategy a step further with new plans that de-emphasize text and voice services in favor of more lucrative data packages.

The new iPhone could hasten the switch to the new plans. Verizon Wireless, co-owned by Verizon Communications and Vodafone Group PLC (VOD.LN), says it will only sell discounted smartphones to people on tiered data plans, meaning that someone who signed up for an unlimited data plan when Verizon started selling the iPhone in January 2011 will have to pay full price to get the latest iPhone or switch to a tiered data plan.

AT&T, meanwhile, says that iPhone customers who want to use the video-calling feature FaceTime over the cellular network will have to sign up for one of the new plans.

In addition, people familiar with the matter say the new iPhone will run on a wireless network technology called LTE, which is faster than the 3G service iPhones currently support.

U.S. carriers have invested billions of dollars building LTE networks, but so far they aren't being used much. At the end of the second quarter, only 12% of Verizon's 89 million customers on contract were using its LTE network, the company said.

Carriers hope the new iPhone could finally prompt many of these customers to upgrade to LTE networks. That promises a double benefit: They handle data more efficiently and cheaply, and the faster speeds could prompt users to watch more videos, download more games and browse the Internet more often than they do currently.

"It is often the case that when a faster network presents itself, customer appetite for data tends to follow," said Bob Azzi, senior vice president of network at Sprint Nextel Corp. (S).

Sprint, unlike AT&T and Verizon, is offering customers an unlimited data plan, so it doesn't stand to make money from more data traffic.

The company is in the early stages of rolling out its LTE network and made an expensive bet last year to carry the iPhone in order to win new customers and keep others from leaving. ( The Wall Street Journal )

Blog : Everything For Money

Post : Carrier Cash Cow?

At stake is how profits in the wireless industry get divvied up and to what degree the carriers reap a return on investments in their newest networks.

In just a half a decade, the iPhone has become one of the most important influences on carriers' profits, and its influence is growing. Carriers like AT&T Inc. (T) and Verizon Wireless pay huge sums for the device and then sell it to their subscribers for much less, a profit-damping subsidy that sends billions of dollars in wealth to Apple.

The carriers have fought back this year, introducing new upgrade fees to reduce the cost of subsidizing all those new iPhones.

But the biggest impact could come from new data plans debuting this summer, which should squeeze more money from subscribers hooked on the new phone's faster data speeds.

Among carriers the hope is that the new iPhone—running for the first time on the fastest fourth-generation networks— will change consumer behavior. Downloading videos and surfing the Web should be a more seamless, and more profitable, undertaking.

Validas LLC, a company that tracks wireless bills, surveyed 275,000 smartphone owners in the U.S. and found a big difference between data use by people who carry LTE phones. People carrying smartphones that weren't enabled for LTE averaged 500 megabytes of data per month in 2012, Validas found. But the average data use for an LTE subscriber was 1.2 gigabytes per month.

"These new devices and the apps that roll with them are going to drive more data usage," Verizon Communications Inc. (VZ) Chief Executive Lowell McAdam told investors Friday. "As you move off of 3G and on to 4G your usage should go way up and your costs should go down."

Carriers have had a good run this year, with shares in AT&T up 24% and Verizon up 10%, fueled in part by better margins. Wall Street is debating whether that mainly reflects the lull between new iPhone releases or a more sustainable reworking of carriers' economics.

From the perspective of telecom companies, the economics of the iPhone boils down to trading high upfront costs for the promise of locking subscribers into higher phone bills under two-year contracts.

U.S. carriers' data revenue has indeed grown quickly since the iPhone was introduced in June 2007—$17.1 billion in the second quarter versus $5.2 billion five years earlier, according to UBS AG (UBS). But analysts have focused on the negative effects of those upfront costs.

This phenomenon is illustrated in the financial performance of AT&T, which became the first company to carry the iPhone.

In last year's fourth quarter, after the iPhone 4S went on sale, 12% of AT&T's cellphone customers upgraded to new phones and the carrier's wireless profit margin plummeted by a third to 29%, according to UBS. In the second quarter of this year, as many people waited for the new iPhone, just 6% of AT&T customers upgraded and the carrier's profit margin shot up to 45%.

To keep those swings from biting deeply into profits, AT&T and Verizon Wireless moved earlier this year to charge customers more for upgrades. Verizon imposed a $30 fee for some customers, and AT&T doubled its upgrade fee to $36.

The carriers are also being less generous than in prior years, when they allowed their subscribers to upgrade to new iPhones well before they completed their two-year contracts.

"We believe this approach lowers the risk that the carriers will capitulate to demand for a hot new device, as they did with some past device launches," UBS analyst John Hodulik said in a note to clients last month that detailed some of the carriers' moves to reduce spending on device upgrades.

More significantly, the new iPhone has the potential to trigger another jump in carriers' data revenue.

Verizon and AT&T have long done away with unlimited data plans for new customers in favor of tiered data plans. This summer, they took that strategy a step further with new plans that de-emphasize text and voice services in favor of more lucrative data packages.

The new iPhone could hasten the switch to the new plans. Verizon Wireless, co-owned by Verizon Communications and Vodafone Group PLC (VOD.LN), says it will only sell discounted smartphones to people on tiered data plans, meaning that someone who signed up for an unlimited data plan when Verizon started selling the iPhone in January 2011 will have to pay full price to get the latest iPhone or switch to a tiered data plan.

AT&T, meanwhile, says that iPhone customers who want to use the video-calling feature FaceTime over the cellular network will have to sign up for one of the new plans.

In addition, people familiar with the matter say the new iPhone will run on a wireless network technology called LTE, which is faster than the 3G service iPhones currently support.

U.S. carriers have invested billions of dollars building LTE networks, but so far they aren't being used much. At the end of the second quarter, only 12% of Verizon's 89 million customers on contract were using its LTE network, the company said.

Carriers hope the new iPhone could finally prompt many of these customers to upgrade to LTE networks. That promises a double benefit: They handle data more efficiently and cheaply, and the faster speeds could prompt users to watch more videos, download more games and browse the Internet more often than they do currently.

"It is often the case that when a faster network presents itself, customer appetite for data tends to follow," said Bob Azzi, senior vice president of network at Sprint Nextel Corp. (S).

Sprint, unlike AT&T and Verizon, is offering customers an unlimited data plan, so it doesn't stand to make money from more data traffic.

The company is in the early stages of rolling out its LTE network and made an expensive bet last year to carry the iPhone in order to win new customers and keep others from leaving. ( The Wall Street Journal )

Blog : Everything For Money

Post : Carrier Cash Cow?

No comments:

Post a Comment